Table of Contents

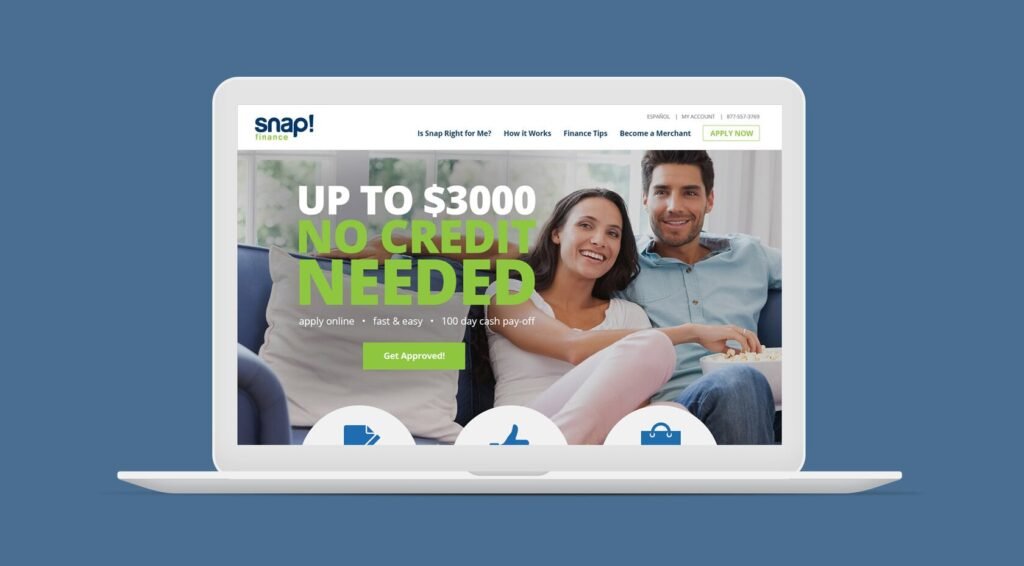

Snap Finance: A Game Changer in Accessible Financing for All

A Full examine through Snap Finance

Buying the things we need or want wasn’t ever simpler than it is right now. As more and more individuals utilize online financial tools, companies like Snap financial services are coming to develop an innovative method of handling purchases without having to pay them at once. Snap Finance grows more and more popular because it offers flexible lending options to both people and businesses. This article passes into many details about Snap Finance, such as what it is, the way it operates, its benefits, and the way it impacts people today.

What is Snap Finance perform?

Snap Finance is an organization which assists people with detrimental or no credit receive loans easily and quickly. Customers may obtain cash to buy items at the participating shops by completing out a simple application. It was created for people who need capital for fundamental or expensive items but cannot obtain typical credit. Snap Finance helps people by allowing them “buy now, pay later,” meaning that they can stretch the cost of their purchases throughout time.

Snap Finance was established to make credit accessible to everybody, so it serves individuals from all walks of life. Customers may utilize Snap Finance to buy something from home appliances to furnishings to devices to healthcare services. The greatest benefit is that the company does not always require an excellent credit rating or a long approval process. This renders it an ideal choice for folks who have had trouble applying to conventional credit systems.

The manner in which does Snap Finance work?

By applying Snap Finance is intended to be easy and accessible. Here is the way it works:

The way to Apply:

The initial phase is to fill off an application for funding through the Snap Finance site or at a store that works with them as well. Individuals who want to apply need to provide basic information about oneself, like their name, residence, and current position. There’s not a requirement to check the applicant’s credit score, but Snap finances will look at their financial situation to determine if they connect the criteria.

Approval:

Snap Finance may approve most applicants almost immediately, unlike other kinds of taking out loans. Typically, the process for being accepted is far faster than an ordinary credit check. According to their financial situation, applicants may obtain loans of $300 to $5,000.

Making a Purchase:

Once acknowledged, customers can use the funds to buy items from stores that are part of the scheme. You will may purchase this online or in individual, depending upon how the store is set up. Clients know precisely when their payments have due as Snap Finance gives these individuals a clear payment schedule.

Early Payment Discounts:

If you’d like to pay off the balance early, Snap Finance could offer you a discount. Those who pay off their loan early can owe fewer dollars in total, which makes it a good choice for anyone who can afford to pay off their debt swiftly.

Fees over Late Payments:

Snap Finance is adaptable, yet there are fees over payments which are missed. Late payment expenses typically smaller than those associated with standard credit cards, but they can still mount up when you don’t pay on time.

Benefits of Using Snap Finance

There are plenty of reasons why individuals are beginning to use Snap Finance. Here are some of the primary benefits:

No Credit Check:

One of the best items about Snap Finance is that you are not required to have a credit check. A lot of people have trouble with their credit scores, which makes it hard to get loans or regular credit cards. Snap Finance helps fill this gap by giving financing depending on how well someone can pay them back instead of their credit score.

Instant Approval:

The submission process is quick and simple, and most customers get approved in a matter of minutes. This is particularly useful for customers who require a thing right away but don’t have the time or credit to go through the long handles of traditional financing.

Payment Plans That Have Flexible:

Snap Finance allows clients choose the payment plan that works most effectively with their budget. The company has a plan that can be modified to suit each person’s needs, regardless of whether they want to pay every week or every month.

No Hidden Fees:

Snap Finance is proud of being transparent and upfront, unlike other loans and credit cards. Clients know exactly what they’re getting into, and there are no hidden expenses. When you get approved, all costs, such as interest rates as well as fees, are clearly laid out.

Snap Finance collaborates with a lot of various kinds of stores, such as furniture stores, electronics stores, medical providers, and more. This allows clients utilize their funding for a lot of different things, which makes it flexible and easy to use.

Opportunity to Build Credit:

Snap Finance does not need a credit score for approval, but using the service responsibly can help improve a person’s credit score over time. Customers can show that they’re financially responsible and slowly build or improve their rating of credit by making payments on timetable and paying off the loan early.

The Drawbacks of Using Snap Finance

While Snap Finance has a lot of positive remarks about it, it might not be right for everyone. Some of the feasible downsides are:

High Rates of Interest: Snap Finance has higher interest rates than typical loans, just like many other short-term loans. The interest rates may be lower than on some payday loans, yet they are still more than what most banks or credit unions provide. This can make it more expensive to buy things in the long run.

Snap Finance imposes late fees if payments are not made in time. These fees are usually lower than credit card fees, but they can still build up over time. Late payments may harm your credit history, which could make it more difficult to get a loan in the future.

Limited Retail Participation:

While Snap Finance works with a lot for stores, it is still not as extensively accepted as other types of payment. To utilize Snap Finance, you need to be sure that the store you wish to buy from is a partner. This makes it less accessible for some customers.

Repayment strain:

While Snap Finance lets users choose when and how to pay back their loans, those who don’t pay on time could feel financial strain. Customers who are unable to adhere to their payment schedule may have to pay extra fines or possibly go to court.

Shorter Loan Terms:

Snap Finance possesses flexible payment plans, but the loan period is usually shorter than with other types of financing. This might result in larger monthly payments that some customers may find diligently to handle.

Snap Finance and How People Live

Snap Finance has changed the way individuals operate, especially when it comes to how much money may spend. Snap Finance makes it easier for people to buy expensive things without becoming broke by allowing these individuals stretch the expense across several months. This change in how individuals shop is most clear in the commerce and healthcare industries, where people usually require borrowed money to make big purchases.

For instance, a person might require a fresh mattress or an operation but not have all the money they need right away. Snap Finance is a good option because it allows people buy these things right away and pay for them over time. People who seek to reconcile their immediate requirements with a stable financial future have found Snap Finance to be an appealing option because of this flexibility.

At conclusion

Snap Finance has altered the way people receive loans, especially for individuals who don’t get enough help from traditional banks. Snap Finance is filling a big need in the financial services sector by avoiding credit checks, giving customers a lot of payment choices, and working with a lot of different stores. But it’s crucial for customers to think about the pros and cons, such high interest rates and late fees. To make sure that Snap Finance remains a useful financial tool and never turns into a burden, you need to borrow wisely and pay it back on time.

In conclusion, Snap Finance is an excellent option for consumers seeking rapid, flexible ways to get money. But as with any other financial product, it’s important to know the terms and use it wisely so you don’t get into debt that you don’t need to. You can take benefit of the ease of use and accessibility that Snap Finance provides if you think carefully about your financial situation and borrow sensibly.

Read about : Mariner Finance

Điểm nổi bật của nhà cái 66b không chỉ nằm ở giao diện thân thiện, tốc độ xử lý mượt mà trên cả điện thoại và máy tính, mà còn ở công nghệ bảo mật tiên tiến, giúp người dùng yên tâm sử dụng dịch vụ mọi lúc mọi nơi. Đặc biệt, deegarciaradio.com hoạt động hợp pháp dưới sự cấp phép của tổ chức PAGCOR – Philippines, đảm bảo yếu tố minh bạch và ổn định trong quá trình vận hành. TONY12-16

I’ve recently started a site, the info you offer on this web site has helped me greatly. Thanks for all of your time & work. “Never trust anybody who says ‘trust me.’ Except just this once, of course. – from Steel Beach” by John Varley.